Introduction

In the fast-paced world of performance marketing, financial stability can sometimes be as volatile as market trends. The business, a prominent marketing agency based in Mumbai, encountered severe financial distress due to unexpected setbacks. This case study outlines how our specialized debt resolution services, particularly through the Company Informal Debt Arrangement (CIDA), provided a lifeline, allowing the company to navigate through creditor harassment, legal challenges, and eventually achieve significant debt relief.

We were able to:

- Stop creditors harassment.

- Re-directed all their creditor’s calls onto us.

- Provided a breathing space to get the business back on track.

- Our advocates were able to stop all creditors legal actions.

- Negotiated settlements at 27.10 Paise on the Rupee.

- ₹1.96 Crores only cost ₹53.15 Lacs.

- Kept the business going and no redundancies.

Background

Client: A Performance Marketing Agency

- Sector: Performance Marketing

- Enrolment with CIDA: 27th July 2022

- Challenge: Handling creditor harassment and legal actions from 11 creditors, amidst cash flow interruptions.

The Challenge

The business faced a daunting challenge in April 2022 when an anticipated cash inflow from a key client evaporated, leaving them unable to meet their financial obligations. The total debt stood at around 2 Crores across multiple banks and non-banking financial companies (NBFCs), with a monthly EMI commitment of 13.5 Lacs. Despite having two secured home loans, the business loans were unsecured, adding to the financial strain. This led to missed payments, attracting aggressive debt recovery actions from creditors, including legal notices and personal visits.

Our Approach

Recognizing the dire need for intervention, the business enlisted our services. Our immediate action plan involved:

- Creditor harassment mitigation, we took over the handling of creditor communication, dealing with 150-200 calls daily. By redirecting these calls to our paralegal team and implementing strategic responses, we significantly reduced the harassment, providing the company with much-needed peace and stability.

- Legal support as the business was facing a barrage of legal notices and actions, our in-house law firm, offered comprehensive legal assistance. We managed responses to notices and represented the company in various legal forums across India, addressing cases of cheque bounces, ECS bounces, and arbitration matters effectively.

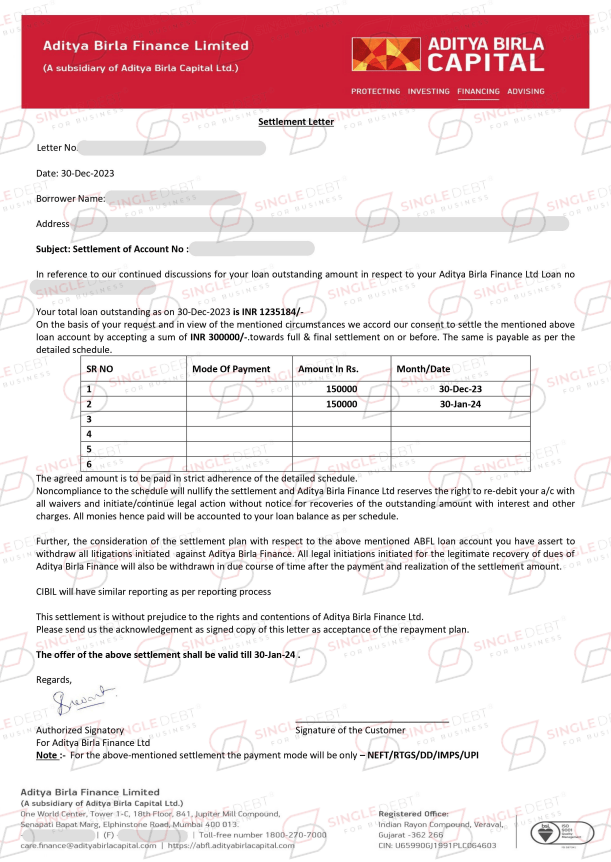

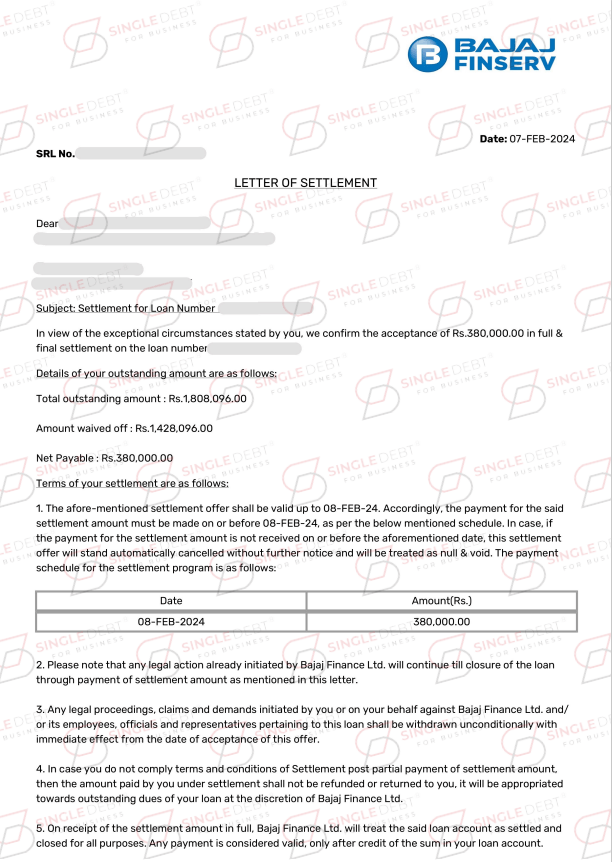

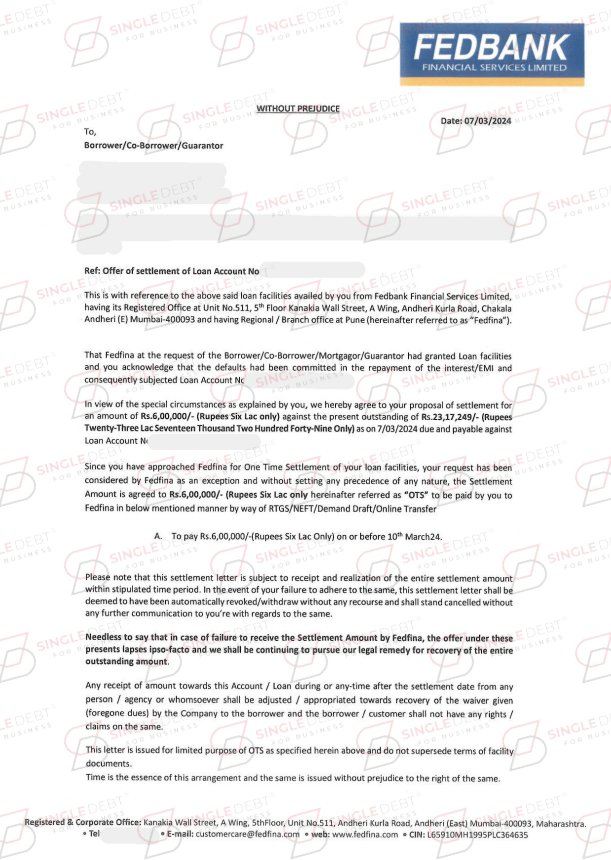

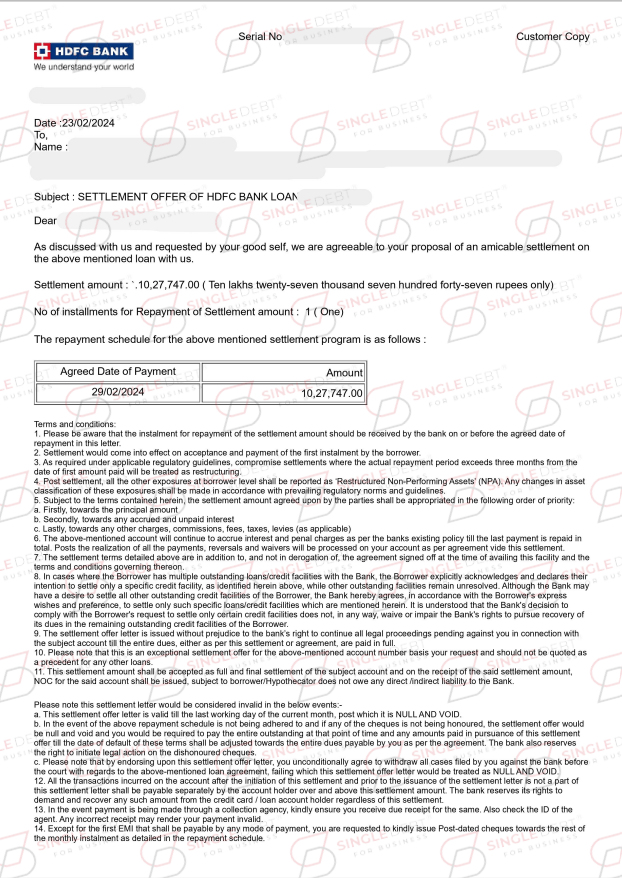

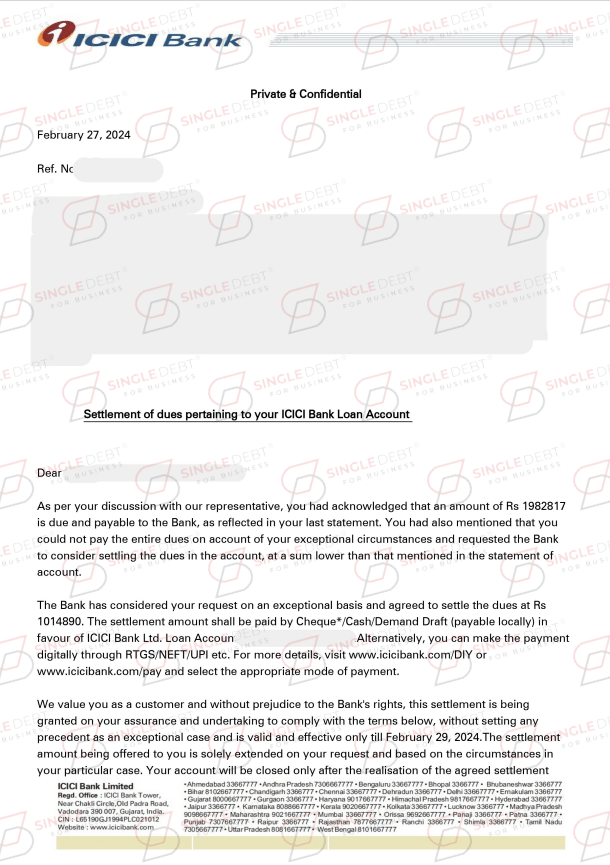

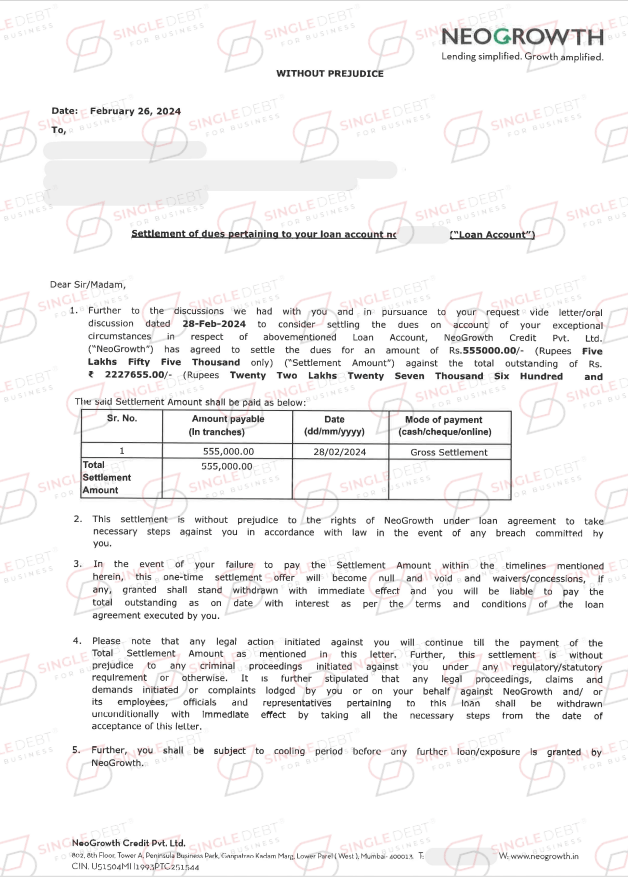

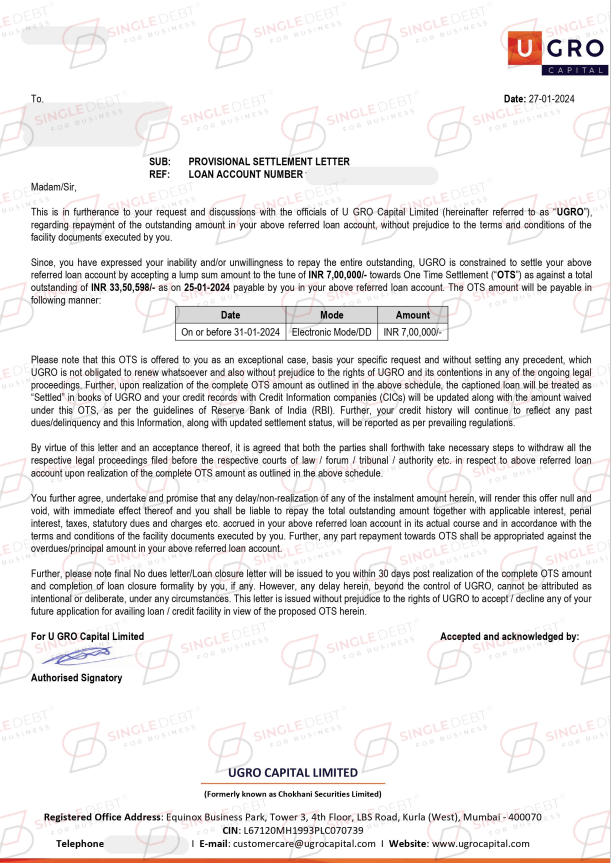

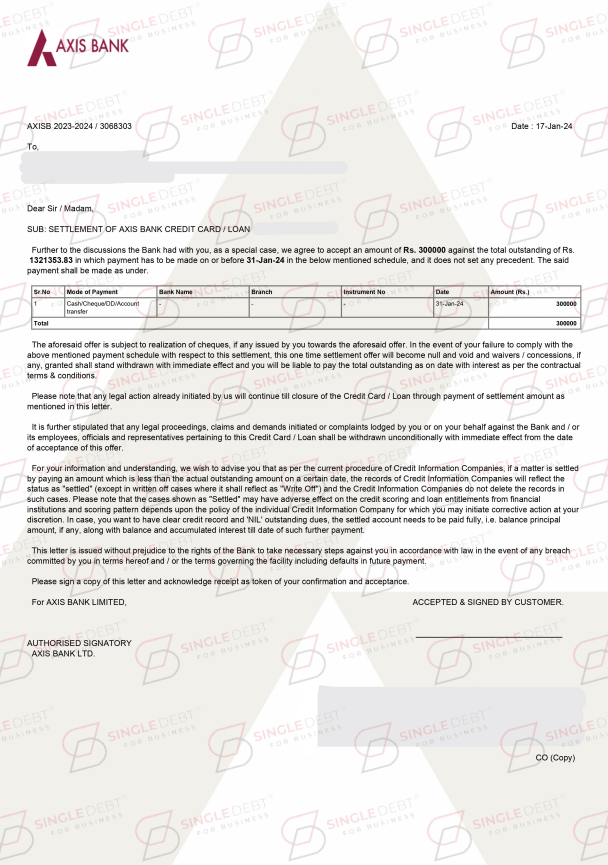

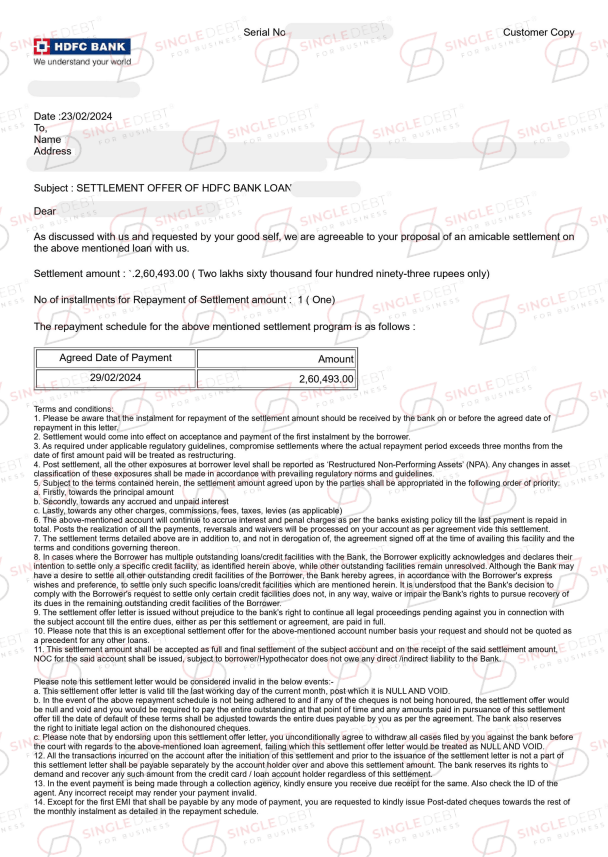

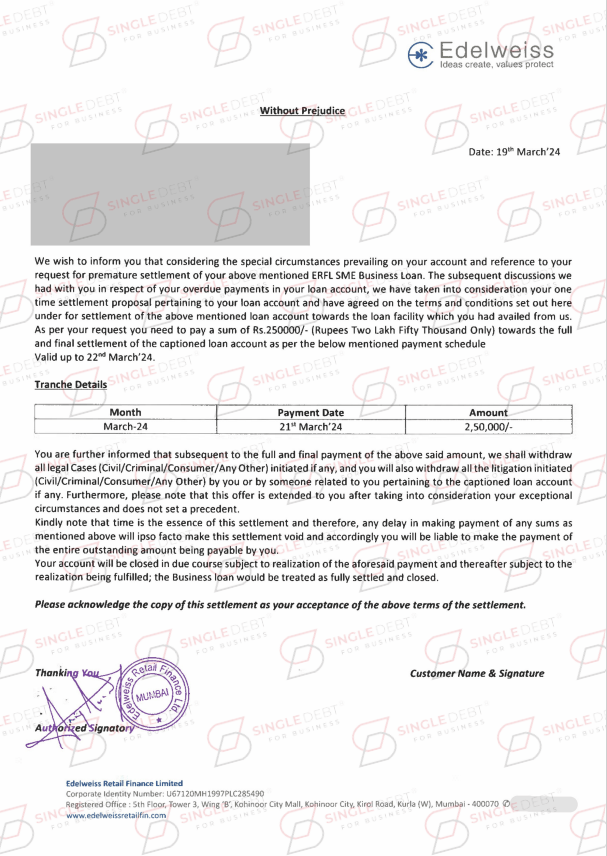

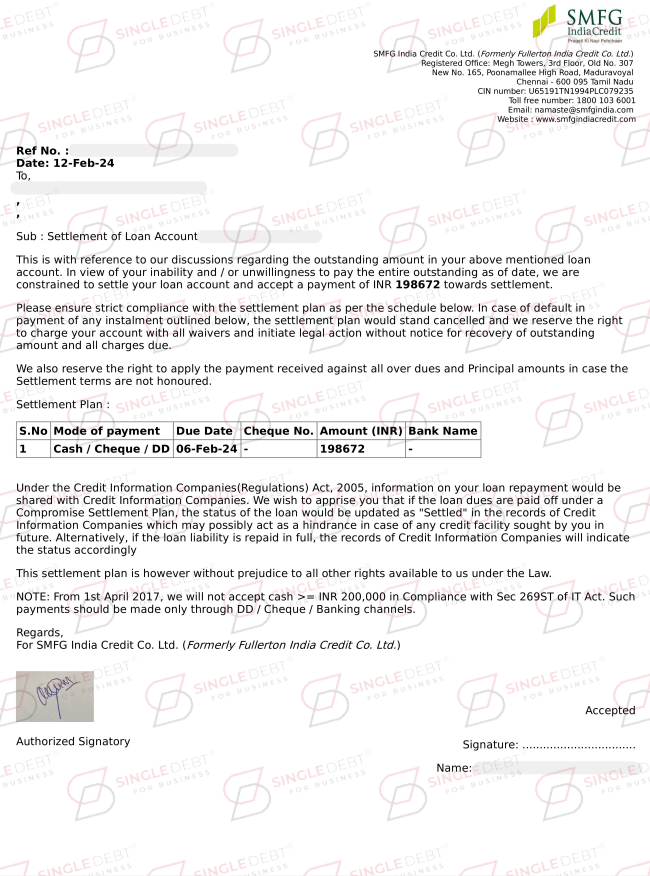

- Debt settlement negotiation was initiated and by December 2023, with the company in a better financial position thanks to the breathing space our services provided, successfully negotiated debt settlements with all the creditors. Our efforts led to settlements ranging from 50% to 80% discounts on the outstanding debts, translating into substantial financial relief for the business.

Outcomes

The table below highlights the success of our settlement efforts, with significant reductions in outstanding amounts, allowing the company to redirect saved funds towards rejuvenating its operations: